Options Trading

Options trading is most suitable for more experienced retail investors, particularly those who carefully research their trades and have a predefined strategy. Wall street is in an uproar over gamestop shares, after members of reddit’s popular wallstreetbets forum encouraged bets on the video game.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg) Essential Options Trading Guide

Essential Options Trading Guide

Options trading (especially in the stock market) is affected primarily by the price of the underlying security, time until the expiration of the option and the volatility of the underlying.

Options trading. The most bearish of options trading strategies is the simple put buying or selling strategy utilized by most options traders. If you are prepared to put some time and effort into learning how to trade well then you can potentially make significant sums of money. Options can be purchased speculatively or as a hedge against losses.

But that doesn’t mean you’re alone. I put trading options in the same category as trading single stocks and other types of commodities like gold and precious metals—it’s highly volatile,. Buying calls can be an excellent way to capture the upside potential with limited downside risk.;

Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right, but not the obligation, to buy or sell that asset at a specific price on a specific. Trade stocks, etfs, forex & digital options at iq option, one of the fastest growing online trading platforms. Understand what is options trading and how to trade in options.

Options trading is a form of active investing in which traders make a bet on the future value of specific assets, including stocks, funds, and currencies. Trading options involves buying or selling a stock at a set price for a limited period of time. Here’s nerdwallet’s guide to how option trading works.

The chicago board of options exchange (cboe) is the largest such exchange in the world, offering options. Understand the risks of options trading. This is one of the option trading strategies for aggressive investors who are bullish about a stock or an index.

Trading options is an increasingly popular form of investment that is accessible to anyone and does not require a huge amount of starting capital. Exchanges, a stock option contract is the option to buy or sell 100 shares; Sign up today and be a part of 17 million user base at iq option.

Trading options is a lot like trading stocks, but there are important differences. As with all securities, trading options entails the risk of the option's value changing over time. Options markets trade options contracts, with the smallest trading unit being one contract.

Option trading is for the diy investor. The market can make steep downward moves. In this article, we'll take a look at.

Securities and exchange commission (the “sec”) or with any state securities regulatory authority. Start option trading today with kotak securities! There are two basic types of options… a call option gives the holder the right to buy shares at a specified strike price.

#1 long call options trading strategy. There are some advantages to trading options. Trading binary options and cfds on synthetic indices is classified as a gambling activity.

But what is options trading? Options trading and volatility are intrinsically linked to each other in this way. Options trading is a lot different from trading stocks or mutual funds, but it can come with some real advantages for investors.

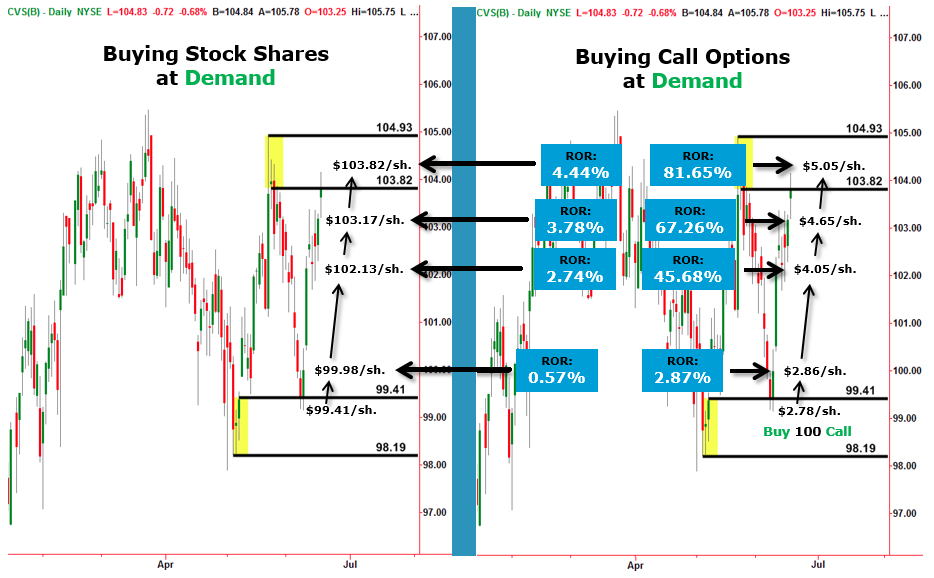

Why trade options rather than a direct asset? Options trading is a type of investing which allows investors to see quick and effective results with limited investments. Generally you would buy a.

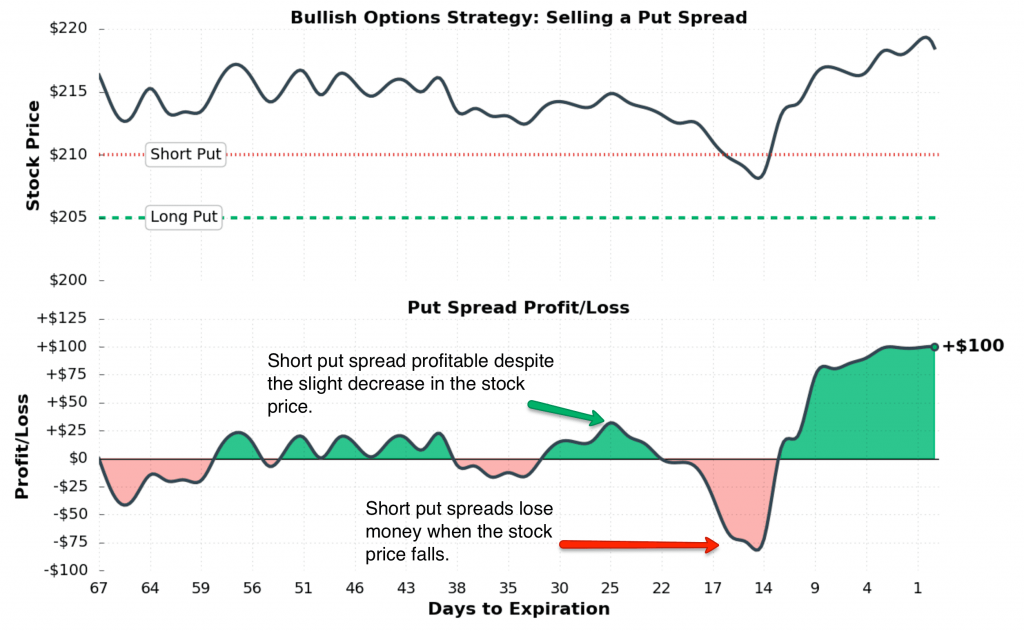

Unlike stocks, options come in two types (calls and puts) and these options are contracts (rather than shares. Moderately bearish options traders usually set a target price for the expected decline and utilize bear spreads to reduce cost. Speculative purchases allow traders to make a large amount of money, but only if they can correctly predict the magnitude, timing, and direction of the underlying security's price movement.

Options trading is all about timing the market, and that is a dangerous game to be playing with your investing dollars. Learn more about responsible trading. Options trading involves a substantial risk of loss and is not suitable for every investor.

And there is a growing roster of. It is the most basic of all options trading strategies. What are puts and calls in options trading?

Therefore, the risks associated with holding options are more complicated to understand and predict. Options contracts specify the trading parameters of the market, such as the type of option, the expiration or exercise date, the tick size, and the tick value. Trading in options requires a relatively low upfront financial commitment compared to regular stock trading, and there is the potential for incredibly high returns on investment as a result.

Options are particularly powerful trading tools. They can be used to bet on and against financial securities, and can magnify returns and losses, which has made them wildly popular among the new. Also read about option trading related terms, its types etc.

What you Must Know before you Start Engaging in Binary

What you Must Know before you Start Engaging in Binary

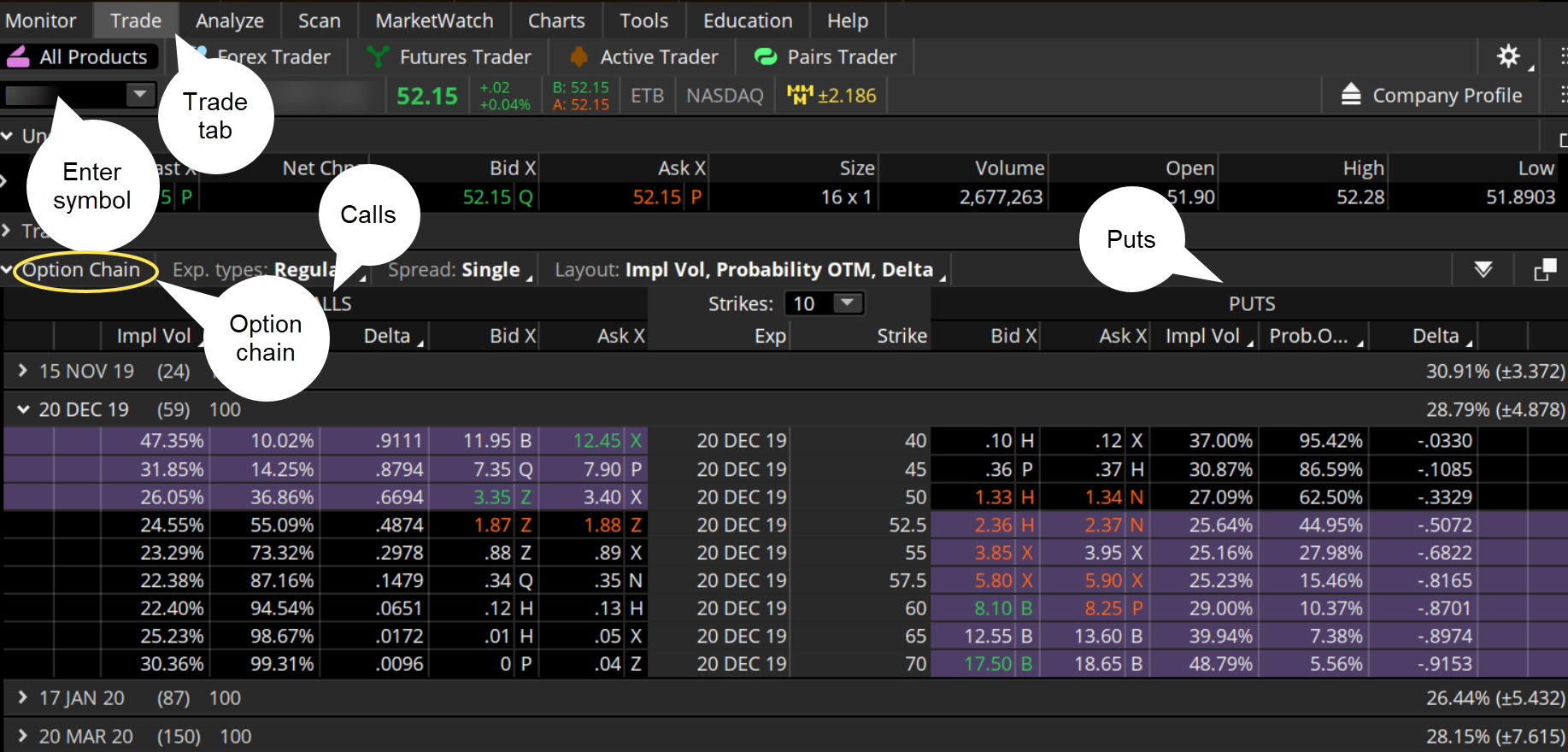

How to Trade Options Making Your First Options Trade

How to Trade Options Making Your First Options Trade

Top 3 Options Trading Strategies for Beginners projectoption

Top 3 Options Trading Strategies for Beginners projectoption

The Misconceptions and Pitfalls of Options Trading Macro Ops

The Misconceptions and Pitfalls of Options Trading Macro Ops

What are Binary Options Trading Forex Winners Free

Professional Options Trading Course Lesson 1, Part 2 of 2

Professional Options Trading Course Lesson 1, Part 2 of 2

Options Are Really Simple Inside Wallstreet Report

Options Are Really Simple Inside Wallstreet Report

Option Prophet Why I Fell in Love with Options Trading

Option Prophet Why I Fell in Love with Options Trading

Options Trading Education Online Trading Academy

Options Trading Education Online Trading Academy

Placing an Options Trade Robinhood

Placing an Options Trade Robinhood

Option Trading Mistakes to Avoid The Trader Institute

What you Must Know before you Start Engaging in Binary

What you Must Know before you Start Engaging in Binary

Is Binary Options Trading Safe?

Is Binary Options Trading Safe?

Options Trading Business Traders Offer Free Forex

Option Trading for Beginners The Ultimate Guide on How to

Option Trading for Beginners The Ultimate Guide on How to

How to seize a trading opportunity using effective chart

How to seize a trading opportunity using effective chart

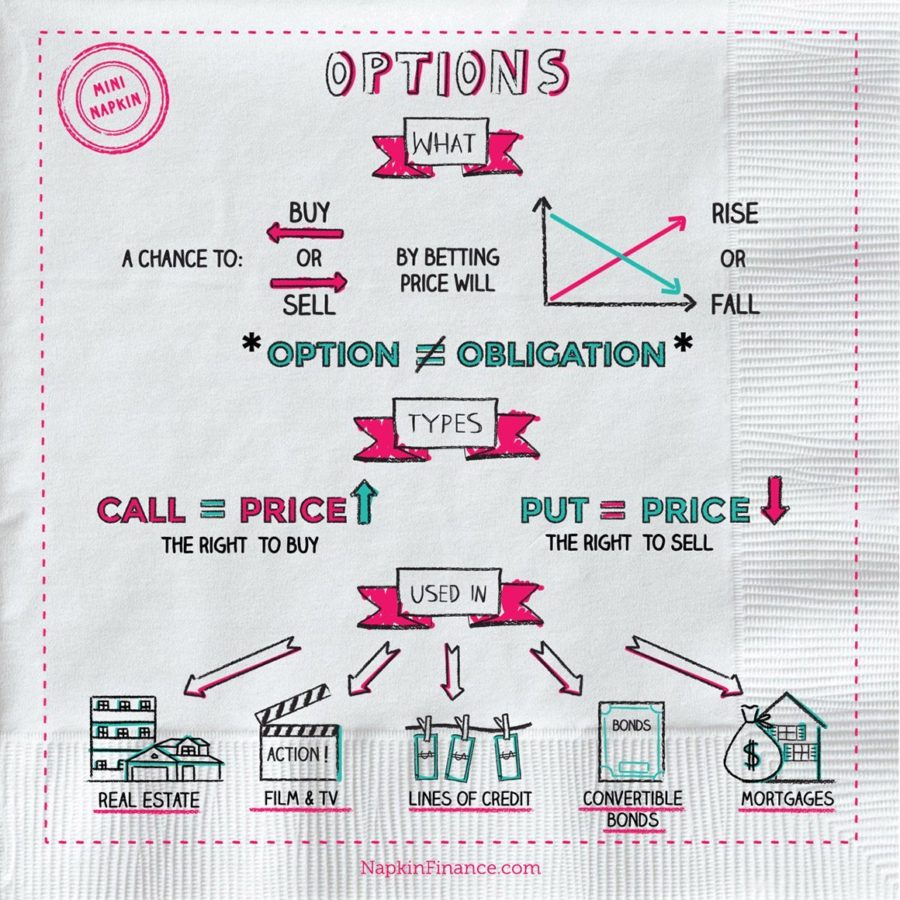

What is Options Trading? What Are Options? Napkin Finance

What is Options Trading? What Are Options? Napkin Finance

How profitable is options trading? How much of a hassle is

Comments

Post a Comment